Trump hosts former head of Syrian Al-Qae... Tue Nov 11, 2025 22:01 | imc Trump hosts former head of Syrian Al-Qae... Tue Nov 11, 2025 22:01 | imc

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Study of 1.7 Million Children: Heart Dam... Sat Nov 01, 2025 00:44 | imc Study of 1.7 Million Children: Heart Dam... Sat Nov 01, 2025 00:44 | imc

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Top Scientists Confirm Covid Shots Cause... Sun Oct 05, 2025 21:31 | imc Top Scientists Confirm Covid Shots Cause... Sun Oct 05, 2025 21:31 | imc Anti-Empire >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Was that not what the War on Terror was about ?

Today things finally came full circle. It was Al-Qaeda that supposedly caused 9/11 and lead to the War on Terror but really War of Terror by the USA and lead directly to the deaths of millions through numerous wars in the Middle East.

And yet today the former head of Syrian Al-Qaeda, Al-Jolani was hosted in the White House by Trump. A surreal moment indeed.

In reality of course 9/11 was orchestrated by inside forces that wanted to launch the War of Terror and Al-Qaeda has been a wholly backed American tool ever since then.

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

That tree we got retained in 2007, is no more

2007

http://www.indymedia.ie/art...

2025

https://eplan.limerick.ie/i...

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

A major study involving 1.7 million children has found that heart damage only appeared in children who had received Covid mRNA vaccines.

Not a single unvaccinated child in the group suffered from heart-related problems.

In addition, the researchers note zero children from the entire group, vaccinated or unvaccinated, died from COVID-19.

Furthermore, the study found that Covid shots offered the children very little protection from the virus, with many becoming infected after just 14 to 15 weeks of receiving an injection.

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Disability Fine Lauder and Passive Income with Financial Gain as A Motive

Why not make money?

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc

A comprehensive study by leading pediatric scientists has confirmed that the devastating surge in heart failure among children is caused by Covid mRNA shots.

The peer-reviewed study, published in the prestigious journal Med, was conducted by scientists at the University of Hong Kong.

The team, led by Dr. Hing Wai Tsang, Department of Pediatrics and Adolescent Medicine, Li Ka Shing Faculty of Medicine, School of Clinical Medicine, the University of Hong Kong, uncovered evidence to confirm that Natural Killer (NK) cell activation by Covid mRNA injections causes the pathogenesis of acute myocarditis.

Myocarditis is an inflammation of the heart muscle that restricts the body?s ability to pump blood. The Saker >>

Interested in maladministration. Estd. 2005

RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony

Joe Duffy is dishonest and untrustworthy Anthony Joe Duffy is dishonest and untrustworthy Anthony

Robert Watt complaint: Time for decision by SIPO Anthony Robert Watt complaint: Time for decision by SIPO Anthony

RTE in breach of its own editorial principles Anthony RTE in breach of its own editorial principles Anthony

Waiting for SIPO Anthony Waiting for SIPO Anthony Public Inquiry >>

Voltaire, international edition

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en Voltaire Network >>

|

Tax Breaks for Commercial Property Will Fuel Bubble

national |

economics and finance |

feature national |

economics and finance |

feature

Thursday November 24, 2016 03:56 Thursday November 24, 2016 03:56 by 1 of Indymedia by 1 of Indymedia

Original article by Stephen Donnelly TD

We are republishing this article by Stephen Donnelly TD who has been doing great work in exposing how Fine Gael have gone out of their away to facilitate vulture funds who are now preying on ordinary people by charging exorbitant rents and fueling the current property and are replacing the English absentee landlord of centuries past, with ruthless vulture funds capitalists of this era and essentially introducing a form of neo-fuedalism as increasing huge swaths of the population are either priced out of buying homes, or are signing up for debt that last close to a lifetime.

Related Links:

Stephen Donnelly, TD submission for a detailed proposal to target €20bn in future avoided taxes. |

Update on the work of NAMAleaks.com

Proposed new tax breaks in the Finance Bill will fuel an existing commercial property bubble in Dublin.

They’ll do this by making commercial property investment, mainly by large foreign landlords, entirely tax free. This will drive up commercial rents, suppress residential development, put Irish banks at risk, and deprive the State of much-needed funds.

As far as I can tell, no other European country offers a tax-free environment on commercial property.

And in light of our recent property bubble, fuelled by foreign capital, it’s difficult to understand why it’s being proposed.

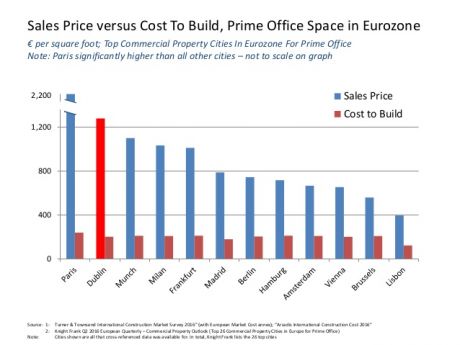

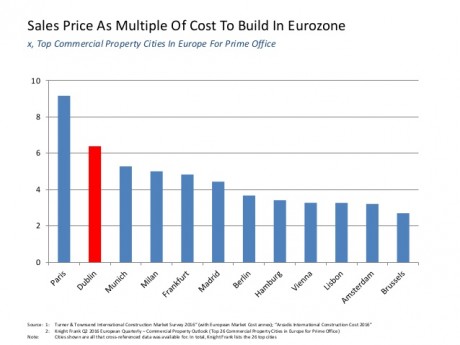

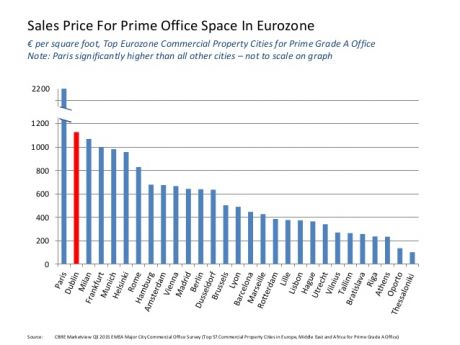

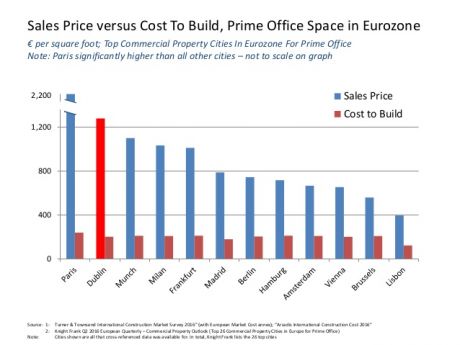

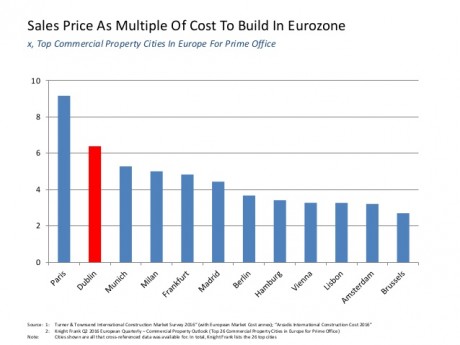

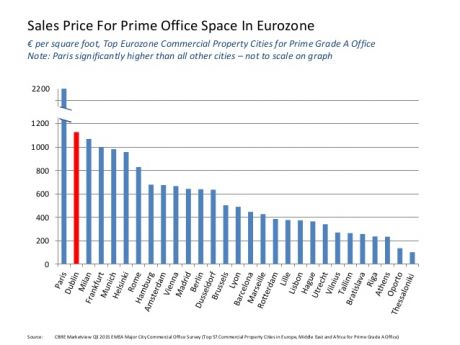

Particularly because we already have a bubble in commercial property in Dublin. Surveys by CBRE and Knight Frank show Dublin to be the second most expensive city in the Eurozone to buy high-quality office property.

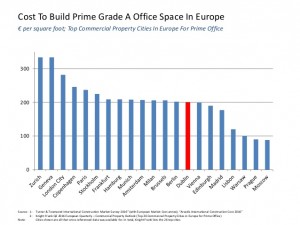

This isn’t due to build costs – international surveyors provide comparative data showing Dublin build costs in line with other Eurozone countries.

It isn’t due to demographic or geographic pressures – Dublin’s population density is low, and the city is surrounded by suitable development land.

And yet, grade-A commercial property currently sells for 6.4 times more than it costs to build.

In Europe, only Paris and London have higher multiples. And that, in anyone’s book, is a bubble. Well, almost anyone’s.

Commercial Property from Stephen Donnelly

Large real estate agents who sell commercial property are paid as a percentage of sales price. So high volumes of sales, at high prices, make them a lot of money. Some will insist there’s no bubble, that it makes perfect sense for this small city on the edge of Europe to have some of the highest prices on Earth.

They’ll point to yields from commercial property as being very reasonable. Exactly the arguments we’ve heard before, from about 2004 to 2008. This bubble damages the economy. Commercial rents have been spiralling in the capital, nearly doubling in the past two years. That’s bad for business, and bad for consumers. Residential development is being suppressed. Right now, decent commercial property in Dublin is selling for more than €1,200 a sq ft, while residential property sells for about €500 a sq ft.

So naturally, developers and owners of zoned land are highly incentivised to build offices, rather than homes.

The bubble also puts the Irish banks at risk. There are numerous new safety valves in place since the Crash, but the last thing anyone wants is for our domestic banks to be lending into another property bubble.

Part of what’s driving this bubble is a raft of recent tax breaks.

Real Estate Investment Trusts (REITs) were introduced in the 2013 Finance Act.

As one international fund puts it on their website, Irish REITS, “unlike other property companies, distribute their income in a highly tax-efficient manner”.

Irish Collective Asset-Management Vehicles, ICAVs, were introduced in 2015.

They are described as follows by a leading law firm: “The ICAV is treated, for Irish tax purposes, as a corporate vehicle which is fully exempt from Irish tax on its income and profits.”

Qualified Investment Funds (QIF) are another legal vehicle used by property investors to ensure tax efficiency, allowing profits be rolled up for several years.

And Section 110 status is used by many so-called vulture funds to lawfully pay minimal or no taxes in Ireland.

What the lawyers and accountants have figured out is that if you combine various tax-efficient mechanisms (let’s say a QIF with a Section 110, or an ICAV with non-domiciled status), then property investors can move from being tax efficient to completely tax-free.

The Finance Bill should be targeting this behaviour to ensure taxes are paid, rather than avoided. Up to now, commercial property in Ireland hasn’t generally been marketed to foreign landlords as tax free.

Many people in the sector believe that, while tax-free status might be possible, it’s not what was intended.

But that’s all about to change.

The Finance Bill creates a new legal classification known as an Irish Real Estate Fund, IREF.

Once investors hold property for five years, they’ll be exempt from all capital gains taxes. It goes on to state that IREFs will, however, pay 20pc dividend withholding tax, DWT. However, it then exempts from this almost every domestic and foreign landlord who buys Irish commercial property.

The era of the so-called vulture funds is coming to an end, as the ECB’s negative yields policy has made most EU real estate too expensive for them. According to CBRE, more than 80pc of all future Irish commercial property investment will come from foreign pension funds, life assurance funds and other Collective Investment Undertakings (CIUs) which includes REITs. All of these will be exempt from DWT.

Irish pension funds are already exempt from taxes in Ireland. However, notwithstanding some exceptions, they don’t get exemptions from taxes when they invest in other countries. Generally, countries don’t give tax breaks to each other’s pension funds, and DWT cannot be reclaimed. It’s unclear then, why Ireland would now choose to give such tax breaks to foreign pension funds investing here.

Similarly, Irish life assurance companies were never exempt from Irish taxes. They do make use of tax deferral mechanisms such as QIFs, but pay their taxes at exit from those schemes.

But not for long. The Finance Bill makes genuine efforts to stop tax avoidance by the so-called vulture funds. This could bring in €10 to €20bn in new taxes to the State in the coming decade. Industry sources working with the vulture funds are confident they can still bypass these new measures, but some additional changes can make this much more difficult. However, it would be a great tragedy to win the battle and lose the war.

As it stands, the Finance Bill will effectively take commercial property, one of our biggest asset classes (possibly our biggest), outside the tax net. There’s no obvious reason for doing this. Other countries don’t. We’re already experiencing a bubble. It’s making things worse for the business community and for people looking to buy homes.

It would cost the State billions in coming years in foregone taxes.

|

national |

economics and finance |

feature

national |

economics and finance |

feature

Thursday November 24, 2016 03:56

Thursday November 24, 2016 03:56 by 1 of Indymedia

by 1 of Indymedia

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter