North Korea Increases Aid to Russia, Mos... Tue Nov 19, 2024 12:29 | Marko Marjanovi?

North Korea Increases Aid to Russia, Mos... Tue Nov 19, 2024 12:29 | Marko Marjanovi?

Trump Assembles a War Cabinet Sat Nov 16, 2024 10:29 | Marko Marjanovi?

Trump Assembles a War Cabinet Sat Nov 16, 2024 10:29 | Marko Marjanovi?

Slavgrinder Ramps Up Into Overdrive Tue Nov 12, 2024 10:29 | Marko Marjanovi?

Slavgrinder Ramps Up Into Overdrive Tue Nov 12, 2024 10:29 | Marko Marjanovi?

?Existential? Culling to Continue on Com... Mon Nov 11, 2024 10:28 | Marko Marjanovi?

?Existential? Culling to Continue on Com... Mon Nov 11, 2024 10:28 | Marko Marjanovi?

US to Deploy Military Contractors to Ukr... Sun Nov 10, 2024 02:37 | Field Empty

US to Deploy Military Contractors to Ukr... Sun Nov 10, 2024 02:37 | Field Empty

Anti-Empire >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

UCC has paid huge sums to a criminal professor

This story is not for republication. I bear responsibility for the things I write. I have read the guidelines and understand that I must not write anything untrue, and I won't.

This is a public interest story about a complete failure of governance and management at UCC.

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Socratic Dialog Between ChatGPT-5 and Mind Agent Reveals Fatal and Deliberate 'Design by Construction' Flaw

This design flaw in ChatGPT-5's default epistemic mode subverts what the much touted ChatGPT-5 can do... so long as the flaw is not tickled, any usage should be fine---The epistemological question is: how would anyone in the public, includes you reading this (since no one is all knowing), in an unfamiliar domain know whether or not the flaw has been tickled when seeking information or understanding of a domain without prior knowledge of that domain???!

This analysis is a pretty unique and significant contribution to the space of empirical evaluation of LLMs that exist in AI public world... at least thus far, as far as I am aware! For what it's worth--as if anyone in the ChatGPT universe cares as they pile up on using the "PhD level scholar in your pocket".

According to GPT-5, and according to my tests, this flaw exists in all LLMs... What is revealing is the deduction GPT-5 made: Why ?design choice? starts looking like ?deliberate flaw?.

People are paying $200 a month to not just ChatGPT, but all major LLMs have similar Pro pricing! I bet they, like the normal user of free ChatGPT, stay in LLM's default mode where the flaw manifests itself. As it did in this evaluation.

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

Evaluating Semantic Reasoning Capability of AI Chatbot on Ontologically Deep Abstract (bias neutral) Thought

I have been evaluating AI Chatbot agents for their epistemic limits over the past two months, and have tested all major AI Agents, ChatGPT, Grok, Claude, Perplexity, and DeepSeek, for their epistemic limits and their negative impact as information gate-keepers.... Today I decided to test for how AI could be the boon for humanity in other positive areas, such as in completely abstract realms, such as metaphysical thought. Meaning, I wanted to test the LLMs for Positives beyond what most researchers benchmark these for, or have expressed in the approx. 2500 Turing tests in Humanity?s Last Exam.. And I chose as my first candidate, Google DeepMind's Gemini as I had not evaluated it before on anything.

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

We have all known it for over 2 years that it is a genocide in Gaza

Israeli human rights group B'Tselem has finally admitted what everyone else outside Israel has known for two years is that the Israeli state is carrying out a genocide in Gaza

Western governments like the USA are complicit in it as they have been supplying the huge bombs and missiles used by Israel and dropped on innocent civilians in Gaza. One phone call from the USA regime could have ended it at any point. However many other countries are complicity with their tacit approval and neighboring Arab countries have been pretty spinless too in their support

With the release of this report titled: Our Genocide -there is a good chance this will make it okay for more people within Israel itself to speak out and do something about it despite the fact that many there are actually in support of the Gaza

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

This story is unverified but it is very instructive of what will happen when cash is removed

THIS STORY IS UNVERIFIED BUT PLEASE WATCH THE VIDEO OR READ THE TRANSCRIPT AS IT GIVES AN VERY GOOD IDEA OF WHAT A CASHLESS SOCIETY WILL LOOK LIKE. And it ain't pretty

A single video report has come out of China claiming China's biggest cities are now cashless, not by choice, but by force. The report goes on to claim ATMs have gone dark, vaults are being emptied. And overnight (July 20 into 21), the digital yuan is the only currency allowed.

The Saker >>

An A&E Nightmare That Exposes the NHS as Anything But the ?Envy of the World? Mon Dec 15, 2025 20:00 | Shane McEvoy

An A&E Nightmare That Exposes the NHS as Anything But the ?Envy of the World? Mon Dec 15, 2025 20:00 | Shane McEvoy

The NHS is often said by politicians to be the 'envy of the world'. But after a 48-hour odyssey through A&E to get an urgent scan for suspected appendicitis, Shane McEvoy is convinced nobody anywhere is envying us.

The post An A&E Nightmare That Exposes the NHS as Anything But the ‘Envy of the World’ appeared first on The Daily Sceptic.

The Covid Inquiry is Instantiating Lies That Make it Worse Than No Inquiry At All Mon Dec 15, 2025 17:53 | Will Adie

The Covid Inquiry is Instantiating Lies That Make it Worse Than No Inquiry At All Mon Dec 15, 2025 17:53 | Will Adie

The Covid Inquiry has allowed itself to degenerate into a cudgel to flog the Tory government of Boris Johnson. But an inquiry that instantiates a lie is worse than no inquiry at all, says Will Adie.

The post The Covid Inquiry is Instantiating Lies That Make it Worse Than No Inquiry At All appeared first on The Daily Sceptic.

Dale Vince Links Bondi Beach Massacre to Israel Mon Dec 15, 2025 15:00 | Will Jones

Dale Vince Links Bondi Beach Massacre to Israel Mon Dec 15, 2025 15:00 | Will Jones

Labour donor and green energy tycoon Dale Vince has sparked a backlash after linking the Bondi Beach massacre to Israel's actions in Gaza, saying Netanyahu "wants antisemitism to be a thing? and "acts to make it so".

The post Dale Vince Links Bondi Beach Massacre to Israel appeared first on The Daily Sceptic.

Labour Has Gone Beyond Lying to Bullshitting Mon Dec 15, 2025 13:32 | Sean Walsh

Labour Has Gone Beyond Lying to Bullshitting Mon Dec 15, 2025 13:32 | Sean Walsh

As he entered Downing Street, Keir Starmer told us he would "tread more lightly" on our lives. In 18 months Labour has gone from merely lying to bullshitting, losing all attachment to reality, says Sean Walsh.

The post Labour Has Gone Beyond Lying to Bullshitting appeared first on The Daily Sceptic.

Right Wins Chile Election on Mass Deportation Platform Mon Dec 15, 2025 11:18 | Will Jones

Right Wins Chile Election on Mass Deportation Platform Mon Dec 15, 2025 11:18 | Will Jones

The Right has won the Presidential election in Chile, with conservative Jose Antonio Kast defeating his communist rival on a platform of cracking down on crime and deporting hundreds of thousands of illegal immigrants.

The post Right Wins Chile Election on Mass Deportation Platform appeared first on The Daily Sceptic.

Lockdown Skeptics >>

Voltaire, international edition

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en

Voltaire Network >>

national |

bin tax / household tax / water tax |

opinion/analysis

national |

bin tax / household tax / water tax |

opinion/analysis

Monday September 24, 2012 23:48

Monday September 24, 2012 23:48 by T

by T

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Comments Titles Only

save preference

Comments (6 of 6)

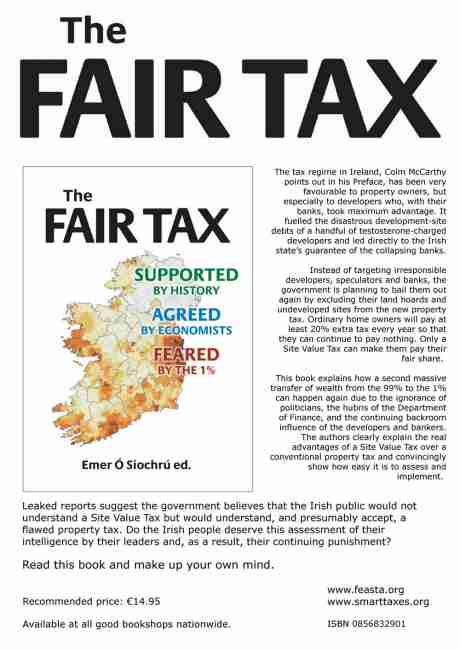

Jump To Comment: 6 5 4 3 2 1Apologies, I have since watched that segment of the programme and they do indeed mention a Site Value Tax, but most of the discussion was about the current Property Tax that the government is planning to introduce and I do agree it is completely unfair. Later in the segment, that economist chap Fred Harrison who was interviewed the other day on radio 1 about Site Value Tax and gave the talk on it in Trinity, actually says the type of Property Tax they are introducing is just going to continue the property boom-bust cycles and he refers to it as a failed property tax which they have in the UK. In his radio interview he clearly identifies such a tax as plain wrong.

I think his idea of a Site Value Tax would have had merit before the bubble started, but now that we are on the other side of it, it would probably unfairly affect people in 'high value' locations who are in negative equity. Nevertheless and I stress again people should give it some thought but keep in mind that the idea (as per interview with Fred Harrison) that Income Tax should be reduced at the same time so that it is tax neutral. That Harrison guy is very clear about targeting developers holding land banks etc.

Anyhow, just for the record, I think we should NOT pay off the banking debt, even though most of the original bond-holders have in fact been paid over with the money we borrowed from the ECB/IMF. On the FrontLine programme, RBB is I think right when he says this money is not going to be used for council services (since they are and will continue to be cut) and will simply be used to close the deficit.

So really all these extra taxes are a mute point. Until the debt is cancelled, there should be complete resistance to all these re-arranging of the deck chairs. One way or another the country will default.

The flat household charge tax of 100 euro is just a small charge in comparison to what they are proposing for a property tax. I think it's something like 0.5% of house value which for a very average dwelling valued at 250,000 is 1,250 per year.

they were discussing this upcoming property tax and how they propose to deal with those who can't pay. They would NOT give exemptions for people on low income or negative equity, but only "deferrals". These would build up until the house was sold / passed on to the next of kin.

After a death, the outstanding debts would most likely force a sale. Over time this would mean poorer people who live in the family home with parent or parents would be faced with sale of the roof over their heads to pay government property taxes

watch the programme. It's clear that this property tax "deferral" is how they are thinking.

The general approach is related to the notion in business of "leveraged buyout" I think.

You leverage the person with unpayable debt forcing a sale / transfer of their assets, often at firesale prices.

Quite aside from the government taking their cut from those who can't pay, what annoys me about the negative equity situations is that essentially, banksters create money out of thin air, loan it to someone who buys a real asset. The person then can't pay because the loan was unsustainable in the first place.

The bankster squeezes as much real money earned from work as possible from the person, then takes the real asset into their balance sheet.

It's like money laundering isn't it?

If the banksters just created money out of nothing then used it to directly buy hard assets such as property and houses, we'd all get our knickers in a twist and object.

But if they do it through a third party (us!), we don't get quite so suspicious of the scam.

The banks are essentially getting our hard assets such as land and property by proxy through us using money they made up out of thin air.

Then we "bail them out" adding insult to injury and in doing so, cripple our real economy.

I didn't see the Frontline programme but are you sure they weren't discussing the Household Tax on it. The above article is about a Site Value Tax and how that differs from a property tax. I would be surprised that the Frontline programme was discussing this. From what you are saying that they talked about "deferring" the charges, this can only mean existing charges -i.e. the Household Tax.

As mentioned in the main article above, the people who launched the book on the Site Value Tax say that have rejected the idea of it. (See the underlined text in main article).

They also make it clear that introducing a Site Value Tax should have a simultaneous reduction in Income Tax -i.e that the overall amount of tax to the revenue is neutral or the same. However we all know that the present government or any future likely government is unlikely to do that and they would just raise all taxes. The Site Value Tax is effectively a wealth tax.

The Household charge is clearly just a flat tax and disproportionately affects the lower paid. It is unjust and I am against it.

I think the Left in general and the Anti-Household Tax campaign won't want to discuss a Site Value Tax it because even though they talk about a wealth tax and the Site Value tax can be just that if done correctly AND at the same time Income Tax is lowered; the compliant mainstream media and the government would completely twist and distort whatever they say on this and put words in their mouth to the effect of saying that they agree with a property tax which would of course be taken out of context. I might also add that I think the mainstream media are generally compliant to the demands of whatever the EU/ECB-IMF want while the government at this stage (and any future government) is simply acting as local technocrats for the financial elite who dictate policy to the ECB and IMF. Lets us not forget this is the same media that sold us all the various wars of aggression and still pimps the War of Terror, the same media that completely hyped the so-called Celtic Tiger and the Irish Property and scared the crap out of many people in their 20s and 30s that if they don't get on the property ladder then they never will and a huge number of these people fell for this propaganda and now face crushing debts for the rest of their lives. One could go on further but I won't.

Thus I think there is not a hope in hell that we will ever see any fair resolution or any useful or equitable measure taken whether it be via a Site Value Tax or any other. Nevertheless I think it is useful for people to read what it is about so they get some understanding of the dynamics of various tax structures and how they can generate or subdue various financial forces and (good + bad) incentives within the economy and society.

on the frontline last monday 24th sept. they discussed deferring the paymentys for those who couldn't pay.

From what was said, It's clear that they are going down the route of quietly building up huge charges over time for those who can't pay which will result in families losing the family home after a parent dies

fred,

Can you clarify your argument. Were you at this meeting of the Fair Tax crowd last night in Trinity and can you indicate what you mean by: They are talking now about "deferring" the tax payment. Who said this?

They are talking now about "deferring" the tax payment

This is essentially taking away the houses of the poor by stealth.

They build up unpayable taxes on family homes then when the house is passed on, the tax has to be paid , or presumably the house has to be sold to pay.

Many Poor families will become homeless within a generation as the family home is taken from them to pay this vile tax on the family home.

It's the old "boil the frog slowly" method of stealing from the poor.

This is a tax on a tax on a tax

We pay tax on our wages. Then we buy a house and pay tax. Then the house is taxed.

Enough!!

No tax on basic family homes below a certain reasonable threshold. People have to live somewhere. It's a basic human right.

Until politicians and non frontline upper administrative civil servants bloated wages are cut below 50k, the poor should not be paying any property tax! I'll consider "taking the pain" when they do too!! Until then they can fuck off.