Big Trouble Ahead for Pensions as Fundamentals of Financial Crisis Remains Unresolved

national |

worker & community struggles and protests |

feature

national |

worker & community struggles and protests |

feature  Saturday October 19, 2013 14:07

Saturday October 19, 2013 14:07 by T

by T

Those Furthest from Retirement Will Lose Most.

The future is not good for pensions and the further away you are from retirement the bleaker is the prospect that you will get anything like you have paid in. A number of factors have come into play to cause major trouble and nearly all of these affect the underlying basic fundamentals required for a pension system to work and along with the continual counter coup to remove the social gains of the past century by the financial elite, the prospects remain grim.

Related External Links:

The Global Demise of Pension Plans |

Dutch Defined Benefit Pension Plans, Second Largest in Europe, Face Forced Cuts | Feb 2011 Pensions, Treasuries, Fannie and Freddie: Ponzi's one and all |

Why And How The Young Are Screwed |

What Ben Bernanke Is Really Saying |

Your Pension Is Under Attack From All Sides. Here's 10 |

Promises, Promises ... Detroit, Pensions, Bondholders And Super-Priority Derivatives |

Derivatives, The Gift That Keeps On Taking |

Irish pension age to increase to 75 |

"It’s a pensions time bomb" - 1 in 5 people stop contributing to their pension | Pension crisis - Inaction is inexplicable | The Pension Time Bomb |

Pensions crisis looms as funds lose €18bn in value (Irish Independent) -Nov 2011 |

Crises in the banking sector and attempts to refinance

Definitions:

Annuity | Gilts

Brief History

Pensions more or less started in 1899 when Charles Booth in England published a pamphlet demanding pensions at 70 although the basic idea is much older and by 1906 the Labour Party passed a motion in the House of Commons advocating Age Old Pensions and thereby had approved them in principle. And two years later on 1st August 1908 Lloyd George introduced the Old Age Pensions Act. The Act provided for a non-contributory old age pension for persons over the age of 70. It was enacted in January 1909 and paid to half a million who were eligible. From that point onwards many groups and workers unions took up the mantle and started to devise their own schemes for their workers and there was continual widening of the scope of who was eligible through various legislative changes. One can only assume that the idea spread rapidly to other countries and likewise adopted. Australia for example also introduced legislation in June 1908 for a flat-rate means tested pension financed from general revenue. It would seem they were slightly ahead of the UK both in time and the fact that the pension was paid to men of age 65 and women of age 60. Ireland being part of the UK in 1908 would have automatically benefited from this and therein has a common root in the history of pensions here.

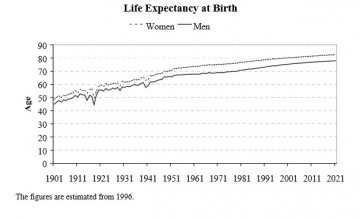

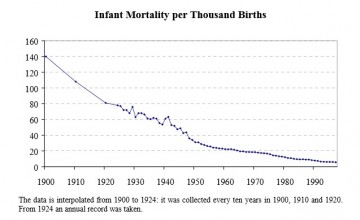

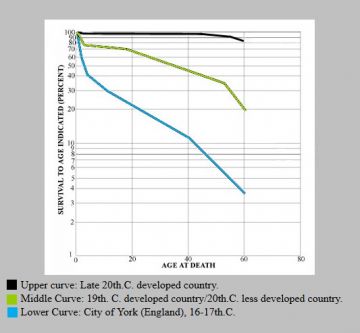

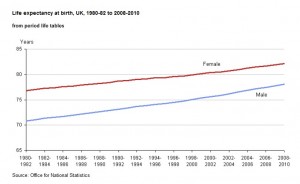

The earlier history of pensions predating 1899 show that various selected groups had pensions such as members of the navy, army, members of some craft guilds and numerous members of the aristocracy. This would have derived from the idea of injury and compensation to the plain privilege of being a member of the upper layers of society. However there was also another dimension which came from trying to deal with the poor and destitute and various countries had ad-hoc measures to deal with these from charities to relief work and so on. Thus the idea of an Age Old Pension can easily be seen as a way to deal with all these people who are just too old to work. In the period of roughly 1550 to 1900 the insurance (including marine insurance) and life insurance came into existence in a form resembling its present form. Given the life expectancy at this time was quite low, there would have been quite decent estimates of how much the state pension was going to cost if it was going to be given to people over a certain age. Figure 1 shows a graph of the Life Expectancy at birth from 1900 to 1998 for the UK whilst figure 2 shows Infant Mortality for the same period for interest sake. The figure for the population of UK in 1901 was 38.3 million rising to 42.1 million by 1911 but given only 0.5 million received the pension in 1908, it shows that in percentage terms (1.2%) it was very few. For example in 2010 in Ireland the number of people receiving a state pension was 390,000 approximately which for a population close to 4.5 million is about 8.6% of the population.

Pension Fundamentals

For most state pensions the money paid out is derived from the money paid in and comes from some kind of "social insurance" paid for in the form of a levy or tax on income whilst private pensions come from contributions paid out of a salary often over a period of 30 to 40 years. In simple terms it is best illustrated by this table below using different contributions for a hypothetical situation where inflation is assumed to be zero. They point here is not so much as to focus on the actual amount but to demonstrate how much it saved for a given amount for a certain number of years and to then illustrate how that corresponds to a certain payout for differing numbers of years taking into consideration in the very early days, on average you lived only for one year after retirement and how this has now stretched out a good deal longer. [The Irish Pension Board supplies an online pension calculator here but you need to be aware of any assumptions it has built in about growth rates.].

One should note for a real pension the contributions are usually index-linked which basically means you have to increase the monthly payment (as you save) in line with inflation so that the amounts are realistic figures for the given period.

Update Nov 1st 2013: Updated table below. Previously divided by 10 instead of 12 for payouts which means they are even worse.

| No of Years | Monthly Contribution | Saved Amount | Payout years | Monthly Payout | Weekly | Retire @ | Die @ |

|---|---|---|---|---|---|---|---|

| 30 | 100 | 12x30x100=36,000 | 1 | 3,000 | 750 | 65 | 66 |

| 30 | 100 | 36,000 | 5 | 600 | 150 | 65 | 70 |

| 30 | 100 | 36,000 | 10 | 300 | 75 | 65 | 75 |

| 30 | 100 | 36,000 | 15 | 200 | 50 | 65 | 80 |

| 30 | 100 | 36,000 | 20 | 150 | 38 | 65 | 85 |

| 20 | 200 | 12x20x200=48,000 | 1 | 4,000 | 1,000 | 65 | 66 |

| 20 | 200 | 48,000 | 5 | 800 | 200 | 65 | 70 |

| 20 | 200 | 48,000 | 10 | 400 | 100 | 65 | 75 |

| 20 | 200 | 48,000 | 15 | 267 | 67 | 65 | 80 |

| 20 | 200 | 48,000 | 20 | 200 | 50 | 65 | 85 |

| 20 | 100 | 12x20x100=24,000 | 1 | 2,000 | 500 | 65 | 66 |

| 20 | 100 | 24,000 | 5 | 400 | 100 | 65 | 70 |

| 20 | 100 | 24,000 | 10 | 200 | 50 | 65 | 75 |

| 20 | 100 | 24,000 | 15 | 133 | 33 | 65 | 80 |

| 20 | 100 | 24,000 | 20 | 100 | 25 | 65 | 85 |

| 10 | 100 | 12x10x100=12,000 | 1 | 1,000 | 250 | 65 | 66 |

| 10 | 100 | 12,000 | 5 | 200 | 50 | 65 | 70 |

| 10 | 100 | 12,000 | 10 | 100 | 30 | 65 | 75 |

| 10 | 100 | 12,000 | 15 | 67 | 17 | 65 | 80 |

| 10 | 100 | 12,000 | 20 | 50 | 13 | 65 | 85 |

Currently when we hear about pensions the figures are in terms of 'how much percentage of working salary' that will be received. The general idea is that people hope to receive some significant fraction of their working salary. In the above table let assume the salary is around about €36,000 per year. The effective tax rate is around 30% leaving about €24,000 after tax. or €2,000 to cover everything which means €100 of that is 5% of €2,000. It should be clear from the above figures that if you are only paying 5% or 10% of your salary towards a pension and you expect to live for at least 10 or 15 years afterward -lets say 15 years because that would bring you close to the current life expectancy then you are only going to receive the equivalent of between 5% and 10% of your old salary per month! You won't heat your house, pay your medical bills, feed and clothe yourself on that. And forget about any holidays. And the free public transport better be still around otherwise you will be completely stranded.

However that is not the full picture and for many decades now the monthly contributions were invested and so the final total amounts were bigger. In effect it allowed you to get something for free through the magic of growth. The next table is the same monthly contribution figures but with the calculations done on a yearly basis for different annual growth rates. The figures are a bit idealized because they assume average growth rates which does not reflect the real world where they go up or down but it does nevertheless give a good insight to the sensitivity of the final amounts to the "return on investment" or growth rate.

| No of Years | Monthly Contribution | Interest | Total Amount | Total Without Interest |

|---|---|---|---|---|

| 10 | 100 | 5.0% | 15,100 | 12,000 |

| 10 | 100 | 7.5% | 16,900 | 12,000 |

| 10 | 100 | 8.0% | 17,380 | 12,000 |

| 10 | 100 | 8.5% | 17,800 | 12,000 |

| 20 | 100 | 5.0% | 39,600 | 24,000 |

| 20 | 100 | 7.5% | 51,900 | 24,000 |

| 20 | 100 | 8.0% | 54,900 | 24,000 |

| 20 | 100 | 8.5% | 58,000 | 24,000 |

| 30 | 100 | 5.0% | 79,700 | 36,000 |

| 30 | 100 | 7.5% | 124,000 | 36,000 |

| 30 | 100 | 8.0% | 135,900 | 36,000 |

| 30 | 100 | 8.5% | 149,000 | 36,000 |

Clearly starting late in your career with 10 years to go is a bad idea but given the huge number of people paying huge mortgages a lot of people have stopped paying or not even started in the past few years so they could well be waiting until much later to start. For those who are paying 30 years the effect of even just a 5% interest rate more than doubles the final amount and at 8% it is trebled. If we take the last figure of 149k and round that to 150k and assume you live 15 years after retirement, that is still only 10k per year or around 200 a week. It something but not a lot and one medical crisis would leave you in a severe financial state and thats without even considering cover fixed costs like the Property Tax. Notice the above calculations don't even include the management costs which would have the effect of wiping off a half per cent or more on the effective interest rate.

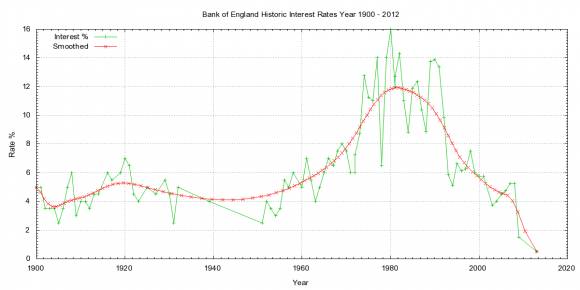

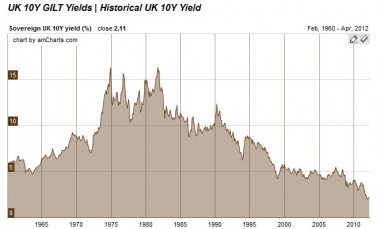

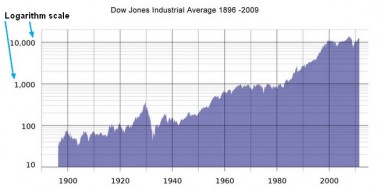

These sort of calculations were probably done years ago and when interest rates were traditionally higher. Figure 3. shows the historic base interest rate for the Bank of England. What is important is the trends. During the 1960s and 1970s when interest rates were high and it was the period of the Defined Benefit pensions where you were guaranteed a pay-out that was a certain fraction of your pension the underlying conditions allowed for this and these were steady and secure employment, employer pension contributions, high investment returns, lower costs of living in terms of rents and mortgages. It was the era of tremendous economic expansion and growth with the prospect that this would continue. For employers it was and still is always in their interest to assume higher investment rates and an assumption of 8% was not unusual because the higher this value, the less they ultimately had to contribute while for the workers a lower assumption gave them the reason to pressurize employers to contribute more. Figure 4 and 5 show the return on Gilts which are basically government bonds and the growth of the Dow Jones Industrial average. respectively. In the case of pensions the money tends to be investigated in risky assets at the start like the stock market which evidently was growing significantly but this has now levelled off and later into the pension contribution period the investments are made in less risky assets like cash and bonds or gilts and again we see in the 70s and 80s these were doing well. So it is not surprising that everything was working out then.

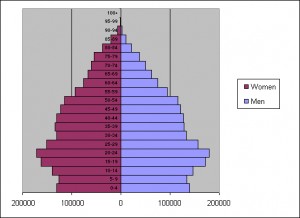

At the same time the average life expectancy for men at least had moved up to 70 years but was a few years higher for women. It still meant that on average you only lived for 5 years after retirement at 65 whereas now with the average hovering around 78 or 79, it is closer to 13 or 14 years after retirement and that equates to paying out nearly 3 times longer. See figures 6 and 7. One can conclude that there must have been huge surpluses in the early years of mass pensions and it was more than adequate to allow for Defined Benefit schemes. As most people know these DB schemes have become extremely rare for anyone who joined the workforce in the last 20 years whereas the Defined Contributions schemes are entirely dependent on the Stock Market for what you get at the retirement.

At retirement the assets in the pension fund are normally cashed-in (by law) as it were and converted into an Annuity which is basically a financial device that pays out a fixed amount for a certain amount of time. So at retirement with your pile of cash you are basically going to a financial firm to get a deal on such a package and in return for a certain price they will guarantee a certain regular payment. They are naturally taking into account your conditions and how long you are likely to last and will factor in the risks and gains of either under-estimating or over-estimating how much they will have to pay-out. Clearly in these turbulent financial times with low interest rates (see Figure 3 again) the value of an annuity you would buy today is probably not going to be as good as someone else might have got 20 years ago for the same amount. The idea of the Annuity is to prevent the situation where you might stick the money in the Post Office or Bank yourself and draw it down steadily and then discover you are out of cash at say 70+ years of age and have no means of generating any income but yet you are otherwise reasonably healthy that you might live another 10 years or so. For the financial companies that provide these annuities they traditionally would have parked your pile of cash in safe forms like cash on deposit although in latter years it is probable riskier mechanisms were used.

The Fundamentals are Broken

For pensions these fundamentals are now broken and have been for quite awhile and is broken in multiple places. We have heard much from the media about the demographic side and this relates to the increasing number of people reaching old age and retirement supported by somewhat proportionally less younger working people. See figure 8. The other half of the demographics is the slowly increasing life expectancy (see figure 7 again) although there are good reasons to believe this has levelled off and may in fact start falling again. The demographics argument seems to be pushed most by the mainstream media because this is blame neutral and gives a good reason as to why the retirement age should be pushed higher.

Less publicised or perhaps less recognised is the falling rate of return as demonstrated in Figures 3, 4 & 5 which are the historical plot of the base interest rate for the Bank of England, Gilt yields and Down Jones average. What is important is the trend sine all other interest rates will follow the same pattern and the pattern has been low interest rates dropping to close to zero for the past years and especially since 2008 when the financial crisis exploded on the scene. The 2008 bust up wiped out nearly all of the gains since the start of the decade in 2000 and much of the recovery in the stock market is both fragile and manipulated largely through the efforts of "quantitative easing" or printing (virtual) money by governments. The incentive for this has been to keep the faith in the system at almost any cost. The result of low interest rates is that money sitting in the bank which is basically what annuities are is generating almost no interest to be used for the pension pay-outs. For example, 100,000 in the bank at 1% gives 1,000 per year whilst 5% gives 5,000 or approximately 100 per week. So if you had 200,000 in the bank at 5% then you are getting 200 per year and hardly hitting the lump sum. It is easy to see how low interest rates used to prop up the economy is killing pensions. This is having a big influence.

In recent years most of the big multinational corporations (most of the airlines, steel producers, car-makers etc) in the US have renegaded on their pensions by going into Chapter 11 bankruptcy and discharging their obligations. The city of Detroit filed for bankruptcy this July and is trying to wriggle out of a $643 million pension shortfall. Overall it is estimate that public pension funds in the US are underfunded by somewhere between $1 trillion and $3 trillion. The practice is spreading to Europe with some companies especially retail chainstores doing selective closures and restructuring. In the UK it is estimated that 80% of UK firms pension schemes in serious deficit. There are 7,800 schemes and already 1,184 have gone bust. Closer to home Waterford Crystal tried to get out of paying a pension deficit, while prior to floatation of Eircom the government put £250 million into its pension fund. More recently Aer Lingus is trying to deal with a pension shortfall of €780 million. ESB has a €1.7 billion gap. And on the smaller scale just last year the 29 workers at Guineys on Dublin's Talbot street, some with 30 years service were told they would not receive pensions. It is highly likely Irish pensions are not much better than the UK situation. There are about 200,000 workers on Defined Benefit schemes and most of these are in serious trouble. Already 400 schemes have closed with employers shifting workers into Defined Contribution schemes which have no guarantees. Many workers in recent years have been asked to increase their monthly contributions to make up for shortfalls even though this may not be enough to bridge the gap and these schemes could still fail. At the moment when Defined Benefit schemes wind up those already retired are protected by law but those who haven't can lose the lot.

"In the era of financial crisis we are re-entering, after a few years' hiatus, even the lowest currently assumed rates of return are very likely to prove to be extremely over-optimistic. The pension math that looks dire at 7% is going to look drastically worse at 2% or less, and once the financial assets held by the funds start to be marked to market at pennies on the dollar, the game will be over. Pensions are not secure. Counting on pay-outs is very risky, as the math is unforgiving. Even near a financial top, and using very optimistic assumptions, it should be obvious that most pensions amount to promises that cannot be kept. Under circumstances of substantial economic contraction, the illusion will disappear entirely."

Source: Promises, Promises ... Detroit, Pensions, Bondholders And Super-Priority Derivatives -from The Automatic Earth blog.

There has been numerous unconfirmed reports that the pension situation is so bad (because interest rates so low) that pension funds have actually been using the contributions made by people who have yet to retire, to cover the pay-out for retired members and that the money is not actually going into investments funds. The game plan is that somehow things will come right again soon and they will try and make up the shortfall in the years ahead. It seems to be a case of fingers crossed. The underlying assumption is those growth periods that we had in the past will come back and preferably soon. This is reminiscent of the gambles Anglo Irish Bank took in its dying days. If this is the case then it is disastrous, but given the state of things it might explain why payments out are still being made and all looks okay on the surface. Again quoting from an article on The Automatic Earth

... For younger generations, which over a broad range have lower income jobs, if they have any, seeing pension plan premiums rise 28%, and then some more and so on, will become unacceptable, fast. They will soon figure out that the chances they will ever get any pension decades from now are close to zero. So they’ll ask themselves why they should pay any premiums, from the pretty dismal wages they make in the first place. Over the next few years, this is a battle that will play out in our societies, and it will have no winners. We need to be very careful not to let it tear those societies apart. In a world where just about everyone has to settle for much less than they have or thought they would have, that will not be easy. Realistic accounting standards would be a good first step, but they will also be very painful. It will be very tempting to hide reality for as long as we can, in the same way we already do with issues ranging from Greece to real estate prices to bank losses to derivatives to our own personal debts....

Source: The Global Demise of Pensions -from The Automatic Earth blog.

Yet another twist in the story is that quite a number of people during the property boom stated that they bought what are now negative equity properties as a means to support them in their retirement. If that is the case then it is unlikely they also have a separate pension plan thus adding to the pool of people who will ultimately have to be helped in some form. On the flip side of this many of those younger people who were hood-winked into paying massively over-priced property are being helped out on day to day living expenses by the retired parents. It is just the scale of this which is unclear. These would be the ones who are on Defined Benefit schemes that they got in the heyday of world growth, decades past. This means the surplus wealth of that era is silently helping out people today. But as these people die off along with their pensions this trans-generational boost will cease, leaving them in greater financial stress. It is like the way in a boom demand from the future is brought forward to the boom time. Luckily for some people the surplus of the past has been brought forward to help them.

Prospects for the FutureSo it looks like we will all be relying on the state pension. The trouble though is that the government has already raised the age you receive it to 68 which means if you retire at 65 with more or less nothing, you will have to wait 3 years for anything from the state. And the dole stops at 65 too. Yet we can't expect too much in the government pot as the National Pension Fund which was setup for funding state pensions has been raided so that it could be poured wastefully into the fraudulent banks. In effect our futures have been robbed to some degree by the banks and their fellow travellers. We can expect the retirement age will be pushed higher with the idea of retirement at 75 being already floated. It is a separate issue whether people will be able to actually physically work till that age. I doubt it.

Calculating how much you need for your pension entirely depends on what you will be spending it on. If you live in a country where there are few social services, privatised health, bad public transport, little community, car dependent sprawl, expensive utilities, charges for waste, water and so on, then you are going to need a lot of money and people would be aware of this in the background and it would increase their anxiety and stress and would likely bring out the selfish streak to get as much as you can now for the years ahead. If on the other hand, you can look forward to a good free health system, a decent public transport system that is free to OAPs, help with utility costs, local shops within walking distance, a vibrant community then you have little need for much money and less worry an anxiety than you might otherwise have in the approaching years. Any sensible person would opt for the second scenario. Unfortunately whereas we had some resembling the second scenario, Ireland is rapidly heading towards the first scenario just at a time when people don't have the pensions, and the pension funds themselves are either broken or in the case of the Defined Contribution ones are at the whims of the fraudulent activities of the market and the parasitic financial layer that feeds off it.

The next best thing people can do is to make their own preparations and to mitigate as much as possible any of the potential problems and costs that you are likely to encounter. First and foremost is to ensure you can remain as healthy as possible for as long as possible so that you are not at the mercy of the health system. This is easier said than done and life throws up many things that you can not avoid, from accidents, heart conditions, medical conditions to the dreaded prospect of getting cancer, all despite your best efforts to avoid. However, you can still shift the probabilities of these things in your favour and educating yourself about and then practicing good diet, exercise and social interaction are all key factors. So much of our food is full of utter crap from sugars to artificial sweeteners to fatty snacks. The key is to go for wholesome foods as close to the raw product. Processed foods tend to be more expensive and less healthy. For those lucky enough to have decent sized gardens, now is the time to practice growing some of your own food (while it is still legal). You will never feed yourself but even if you managed to provide 5% or 10% of your own, it represent something. Now could be the time to try and get allotments going in your area if the space exists.

On the exercise front, getting into the habit of walking and cycling is good too, because it keeps up your strength. When you are car-less later because you are either too old or can't afford it, you will want to be well used to exercise for decades already otherwise there is little chance then. On the social and community side it is a good idea to get involved locally now if you can and build up some social capital. It is the loneliness that can be hard after a live of work. Joining clubs and groups of various kinds will bring you into contact with like minded people.

For dealing with the main utilities of heating, waste, electricity, water and phone, the strategy should be to start now while you can to insulate your house and reduce costs. You won't have the capital later to do it. For waste, getting into the habit now of recycling and composting can help there and avoid buying endless heavily packaged stuff that you don't really need. These are habits built up over years with the help of advertisers and they can take years to shake off. For phone it is hard to see how to mitigate this and given the subsidy for this was abolished by the government in the budget this year, this is a major stumbling block. Perhaps some software activists could write something that would turn peoples WiFi's into local community phone exchanges as a way to share the cost of the landline rental and give a way for people nearby to get onto the phone and internet network

The basic idea is that if the state is not going to be providing for your needs in the future then you need to be part of the process to spontaneously create them yourselves with the people around you. The hardest part could well be overcoming urban sprawl where it is so bad you need a car for every trip to the shop. In future years living in such a place would be a massive drain on extremely limited finances and is the sort of place that leaves you very isolated and cut-off. Perhaps the only thing is to consider moving now while you are able and have time to get used to new places but again for those stuck in negative equity, it is not so simple.

Prospects for Future Growth

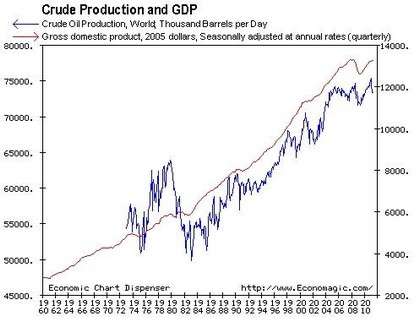

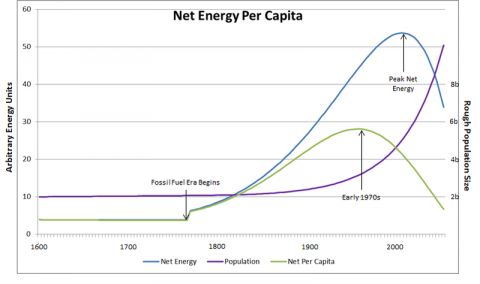

Whilst there may be growth in some regions on a temporary basis, overall the prospects are that we will be facing NOT growth but contraction globally. This means the game is over and we have entered a completely new era with a new set of rules. The reasons are quite simple. They are because we will have passed peak energy and the consequent knock on effects whereby the cost of maintaining our complex society will exceed the costs of what is available. Some of these maintenance costs are represented in terms of environmental costs while others are just the task of maintaining and natural replacement of the infrastructure. Already the peak of cheap energy has passed and the race to find and exploit lower grade energy sources like shale oil, shale gas and deep sea oil is well under the way but the costs of extracting these is far higher and this in turn impacts growth because as the fraction of energy and resources you must devote to extracting energy increases then the less energy there is left over for other uses and since practically all of the energy is used for maintaining and running the present system, then when growth ceases in total energy available to society, you are in trouble. See figure 10 for the close relationship between energy and GDP. In the case of shale gas the depletion rates are as high as 60% in the first year which means it is only a temporary holding position at the cost of massive external costs like widespread contamination of the water table. Practically all the other unconventional fossil fuels have much higher carbon footprints all of which exacerbate global warming just when we should be radically cutting back. The energy available per capita is estimated to have peaked in the 1970s and this neatly corresponds to the era of growth and defined benefit pensions when the stock market was giving the needed returns. See figure 11 which has an estimate for global energy per capita. You can see how more people are added there is less to go around.

In some respects the financial crisis, which is not solved in any way, besides having it's origins in the parasitic nature of the financial elite which in itself reflects a certain evolution (but not in the progressive sense) of the capitalism system in response to the economic, political and physical environment, has occured because of the way the era of cheap energy is over and the real costs are higher because in the "good years" the system was able to expand rapidly because of the vast store of energy for the physical side of things to happen and this in turn was lubricated in the economy by money, credit, debt and financial mechanisms.

The fact that things were growing meant the monetary wealth generated by the expansion today could pay off the interest on all sorts of things tomorrow. And this idea of creating debt to get around funding obstacles built up a huge overhang to such an extent, it ran completely ahead of all the growth that might ever concievably occur. For instance the real physical economy is estimated to be about $60 trillion a year whereas the size of the financial economy which includes all those derivatives is hundreds to thousands of times bigger. That makes no sense. And like all bubbles the limits and constraints of reality in terms of available energy and the limit of abuse the environment can take, caused this notional bubble to burst. All efforts since 2008 have merely been frantic efforts to stop a deflation chain reaction as debt got written off by printing and promising money and cruically convincing people everywhere to keep the faith and we can get back to where we were. This is why the hundreds of trillions of derivatives cannot be "marked to market" because they are actually worthless and what the financial elite are essentially trying to do while keep the situation calm is to swap their junk paper into real physical assets like property, roads, bridges, mines, farmland, timber, industry partially through the trick of austerity and privatisation while we the people will be holding the worthless paper via our banks and when it comes time to pay out the social dividend there will be nothing to pay out with.The above article is based on the reading and research of a number of articles and other material. Some of these can be found in the links below.

Some related links

http://www.parliament.uk/documents/commons/lib/research/rp99/rp99-111.pdf

http://www.cso.ie/en/statistics/healthandsocialconditions/recipientsbytypeofstatepensionnumber/

http://mthwww.uwc.edu/geography/demotrans/demodef.htm

http://uktaxdubai.com/2013/04/20/uk-pension-crisis/

Pensions_Calculators/

http://questioneverything.typepad.com/question_everything/2013/09/what-might-the-dynamics-of-net-energy-per-capita-look-like.html

http://mthwww.uwc.edu/geography/demotrans/demodef.htm

One Option Left -John Michael Greer

Growth is Obsolete -by James H. Kunstler